Market Value 727 Billion. For fair value hedge we consider hedging gain or loss arising from hedging instruments in profit or loss statement.

Sold out of 0 stocks.

. Clearing CME Globex Floor CME ClearPort. This cookie is used for tracking embedded service. New Purchases 1 stock.

The concept has been most commonly associated with the financial sector. As marine fuel prices become more volatile in the next year ahead of IMO 2020 effectively hedge your price risk with our full range of cash-settled marine fuel futures contracts available worldwide. A transaction tax is not a levy on financial institutions per se.

Entity A has designated the swap as a hedge of the changes in fair value of the fixed-rate note due to changes in the designated benchmark interest rate and Libor as the benchmark rate risk being hedged. Hedge rates reflect EBIT impact of the US hedge portfolio 1 Total hedge amount contains and designated hedges. Q1 2022 Cash Evolution 9-07-04-00-02 12 77 77 Net Cash Position December 2021 Gross Cash Flow from Operations Change in Working Capital Cash used for investing activities before MA MA Pensions Others Net Cash Position March 2022 2.

A stop-loss order triggers a market order when a designated price. 769 Turnover Alt 2. The cookie is set when the visitor is logged in as a Pardot user.

I know the answer a year or two ago would have hands down been Guggenheim but SVB has taken major strides in healthcare in the past year with some of their biggest accomplishments having recently been the lead sell-side advisor in the 6bn sale of LHC Group to UnitedHealth lead bookrunner on the 33bn IPO of Komondo. This cookie is provided by LinkedIn. This cookie is used to make a probabilistic match of a users identity outside the Designated Countries.

Reduced holdings in 4 stocks. Top Gear UK vs Top Gear Australia Series Sixteen Episode Two. World Taxi Racing Championship Series Twenty Episode Two.

Moneycorp CFX limited is a company registered in. Side-car deals are much smaller and less complex than catastrophe bonds and are usually privately placed. Travel money services are provided by Moneycorp CFX Limited.

If transaction has not been designated as fair value hedge then also it will be considered under profit or loss statement considered as speculative gain or loss. Rather it is charged only on the specific transactions. A 457 plan is a retirement plan that some state local government and nonprofit employers provide for their workers.

Since the critical terms principal vs. Which firm is better in healthcare. We cant really offer any more advice than what is in the blog and linked guidance so OI would recommend speaking to a solicitor if you are concerned as to what the.

Top 10 Holdings 9955 Turnover 1. Sally - a boundary can be a party one if designated as such at some point in time between neighboursowners or if there is no information to suggest otherwise. A financial transaction tax FTT is a levy on a specific type of financial transaction for a particular purpose.

1430 quarters Time Held All. IFRS 9 allows an alternative of designating full or the intrinsic value of an option as a hedging instrument IFRS 9624a. Additional Purchases 2 stocks.

Traders can have more control over their trades by using stop-loss or stop-limit orders. 130 Time Held Top20. To obtain an exemption application or for further information on the.

It is not usually considered to include consumption taxes paid by consumers. These are relatively simple agreements that allow a reinsurer to transfer to another reinsurer or group of investors such as hedge funds a limited and specific risk such as the risk of an earthquake or hurricane in a given geographic area over a specific period of time. Therefore Entity A qualifies to use the shortcut method.

Intrinsic value and time value of an option Intrinsic value as hedging instrument. 1738 quarters Time Held Top10. Market participants may be eligible to receive an exemption from position limits in accordance with Rule 559 based on having bona fide hedging positions as defined by CFTC Regulation 13z1 risk management positions andor arbitrage and spread positions.

Roth IRAs are available to anyone who meets specific income requirements. Time value of an option is often the only composite of a premium paid and is considered by risk managers as a cost of hedging IFRS 9BC6387. Marine Fuel 05 Fact Card.

Prior Market Value 8869 Billion. The article looks to explain this for you. Notional amounts and maturity vs.

Yes you can apply for a hedge exemption. My question is if both treatment are looking similar then why there. Moneycorp FRM is a trading name of Moneycorp Financial Risk Management Limited which is authorised and regulated by the Financial Conduct Authority for the provision of designated investment business firm reference number 452443.

A common theme on Top Gear is an approach to reviewing cars that combines standard road tests and opinions with an extremely unusual circumstance or with a challenge to demonstrate a notable characteristic of the vehicle.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

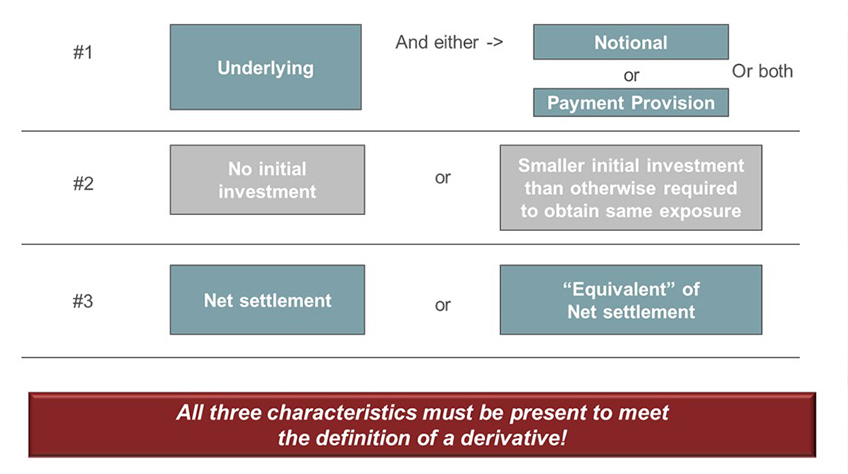

Derivatives And Hedging Gaap Dynamics

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Hedges Of Unrecognized Foreign Currency Denominated Firm Commitments The Cpa Journal

Peoplesoft Enterprise Risk Management 9 0 Peoplebook

Peoplesoft Enterprise Risk Management 9 0 Peoplebook

Derivatives And Hedge Accounting An Overview Of Asc 815 Gaap Dynamics

0 comments

Post a Comment